When I talk with parents about their biggest financial concerns and goals, saving for college inevitably comes up in the conversation. And I understand why college savings is on their minds. The average 2015 graduate will have to pay about $35,000 back in student loans and about 70% of 2015 college graduates left school with student debt, as shared in this Wall Street Journal article. Yeesh! Not to mention the results of this college cost calculator can be a little depressing.

Before we even start talking about college savings, I remind parents that while saving for their child’s college education is extremely generous, it’s more important to have an emergency fund in place, pay off debt, and save for their own retirement first. There’s no guarantee their child will go to college, but I’m pretty sure they’ll want to retire one day. Plus, students have several options in paying for their college education: student loans, work-study programs, scholarships, community college and then 4-year school, etc.

So if you’re ready, here are several ways to start saving money for college:

529 Plan

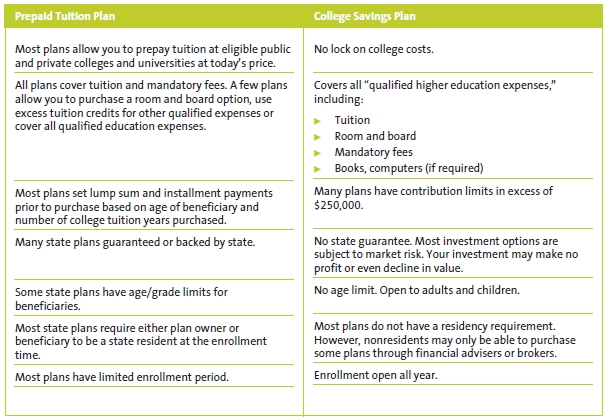

One of the most popular ways to save money for college is through a 529 plan, named after Section 529 of the Internal Revenue Code. The 529 plan is a tax-advantaged savings plan sponsored by states, state agencies, or educational institutions. Earnings on withdrawals for qualified higher education expenses are exempt from federal and state taxes. Additionally, if you invest in the state 529 plan where you are a resident, there may also be a state tax deduction (subject to recapture under certain circumstances, check your plan document to be sure). There are two types of 529 plans: college savings plans and pre-paid tuition plans. This chart from FINRA does a great job comparing the two:

Source: FINRA – Smart Saving for College

Spoiler alert: We live in Illinois and chose to go with Bright Start, an Illinois 529 college savings plan. Bright Start is a bit more DIY, in comparison to Bright Directions which is an Illinois 529 plan available through investment professionals (which has higher fees). Another option is to invest in a 529 plan from another state (for example, Vanguard has a 529 plan through Nevada), but then you may lose any of your state’s tax advantages. This is a nice summary of state income tax 529 plan deductions.

Another benefit of the 529 plan is that anyone (parents, grandparents, other relatives, etc.) can contribute to the plan up until the account value reaches the state determined limit. In Illinois, that’s $350,000 per child. And this is a nice summary of gift and estate tax benefits in doing so (as of the 2015 tax year):

- Contribute up to $14,000 ($28,000 for married couples) per student each year, or up to $70,000 ($140,000 for married couples) prorated over a five-year period to someone’s existing account, without incurring a federal gift tax.

- Grandparents, relatives and friends can open their own 529 plan for a student, contribute $14,000 ($28,000 for married couples) per student each year, or up to $70,000 ($140,000 for married couples) prorated over a five-year period, and not incur a federal gift tax.

- Contributions to 529 plans are also excluded from an account owner’s estate when taxes are assessed.

Some parents are concerned about the penalties if the funds aren’t used for college since any earnings you withdraw from a 529 plan that aren’t used for qualified higher education expenses are subject to both taxes and a 10% penalty (the amount you’ve contributed is never subject to either). If you have multiple children, you can always change the account beneficiary. So if Sibling A doesn’t go to college, you can designate the funds for Sibling B’s use.

Additionally, if your child receives a scholarship then you can typically withdraw up to the amount of the scholarship from your 529 without incurring any penalty. You’ll still have to pay taxes on the earnings, but avoiding that 10% penalty helps.

Either way, opening a 529 plan is relatively simple, so I recommend going with a direct-sold plan as opposed to an advisor-sold plan since those can cost thousands of dollars more over time due to the higher commissions and fees. If you do need help setting up a 529 plan, work with a fee-only or hourly financial planner (like me!) who will give you unbiased advice and help you enroll in the direct option that is best for you.

Coverdell Education Savings Accounts

Another tax-advantaged way to save for college is with a Coverdell Education Savings Account (ESA). Like the 529 plan, earnings in ESAs are tax-deferred and contributions are not deductible at the federal tax level. However, there is no state income tax deduction available for ESAs. And when it comes time to pay for education, withdrawals from an ESA that are used for qualified education expenses are tax-free. Notice that it doesn’t say qualified higher education expenses. One of the advantages of an ESA is that the funds can also be used for private elementary and high school expenses, in addition to college. Additionally, there are virtually no investment restrictions with an ESA. And similar to the 529 plan, funds not used for qualified education expenses are subject to both taxes and a 10% penalty, but ESA beneficiaries can be changed at any time.

However, ESAs have a much lower contribution limit than a 529 Plan. You can only contribute up to $2,000 to any one beneficiary assuming you meet the ESA income limits. And the total of all contributions to all ESAs set up for one beneficiary cannot exceed $2,000. So if you and your child’s grandparents open an ESA, make sure that the combined total of contributions in one year does not exceed $2,000.

As for the income limits, a couple filing a joint return for tax year 2015 can contribute $2,000 if their modified adjusted gross income (MAGI) is less than $190,000 a year. The ability to contribute is phased out for couples filing jointly with MAGI of between $190,000 and $220,000. Contributions are not allowed for couples filing jointly whose MAGI is $220,000 or above.

Single taxpayers will be able to contribute $2,000 if their MAGI is less than $95,000. Single taxpayers’ ability to contribute is phased out if their MAGI is between $95,000 and $110,000. No contributions are allowed if their MAGI is $110,000 or above.

If a Coverdell ESA sounds like the right option for you, here’s where you can open an account.

UGMA/UTMA Custodial Accounts

The Uniform Gifts to Minors Act (UGMA) and the Uniform Transfers to Minors Act (UTMA) are types of custodial accounts that are set up by an adult on behalf of a minor. All of the money in these accounts is turned over to child once they reach the age of majority (18 to 21, depending on the state in which the account was opened) and they can use the funds in any way they choose. You can contribute $14,000 per year, per child without incurring a federal gift tax.

There are a few benefits to UGMA/UTMA custodial accounts, mainly the multitude of investment options and no limitations on contributions. However, unlike the 529 plan, UGMA/UTMA custodial accounts are not tax-deferred and the overall taxation can be a little tricky. The first $950 of earned income from investments in a UGMA/UTMA is generally tax-exempt. The subsequent income up to $950 is generally taxed at the child’s rate. Any income earned over $1,900 is generally taxed at the parent’s rate.

And then there’s the whole control issue. Once the child is a legal adult, they can do whatever they want with the investments. So while you may have hoped your child would use the money for college, there’s no guarantee they’ll be responsible with the funds.

Investment Accounts

You can also put money away for college in a brokerage (investment) account with somebody like Betterment or Vanguard. This gives you the most investment options (like mutual funds or individual stocks) and control over the assets. Plus, there are no contribution limits. But then you’ll have to pay federal and state taxes on the earnings each year.

Your Roth IRA

Yes, a Roth IRA account is generally used to save for retirement, but you can pull out your contributions to pay for college and just pay the tax on any gains. And keep in mind, you can only contribute $5,500 to a Roth IRA per year as of 2016 (or $6,500 if you are over the age of 50), subject to income limitations.

Savings Accounts

Sure, you can always put money away for college in a savings account, but the returns are very, very low. Though one benefit of checking accounts, savings accounts, money market deposit accounts, and certificates of deposit is that they’re covered by the FDIC. , up to $250,000 per depositor, per insured bank, for each account ownership category. If you do decide to use a savings account, an online bank like Ally or CapitalOne 360 will offer slightly better returns than a regular brick and mortar bank.

If you’re interested in setting up a college savings plan for your child or create a comprehensive financial plan, I’d love to work with you!